Accrual basis vs. Cash Accounting: Which Method is Right for You?

Did you know 82% of Fortune 500 companies use accrual accounting? This method might seem complex, but it's key to your business's financial health. Knowing the difference between cash accounting can change how you make financial decisions.

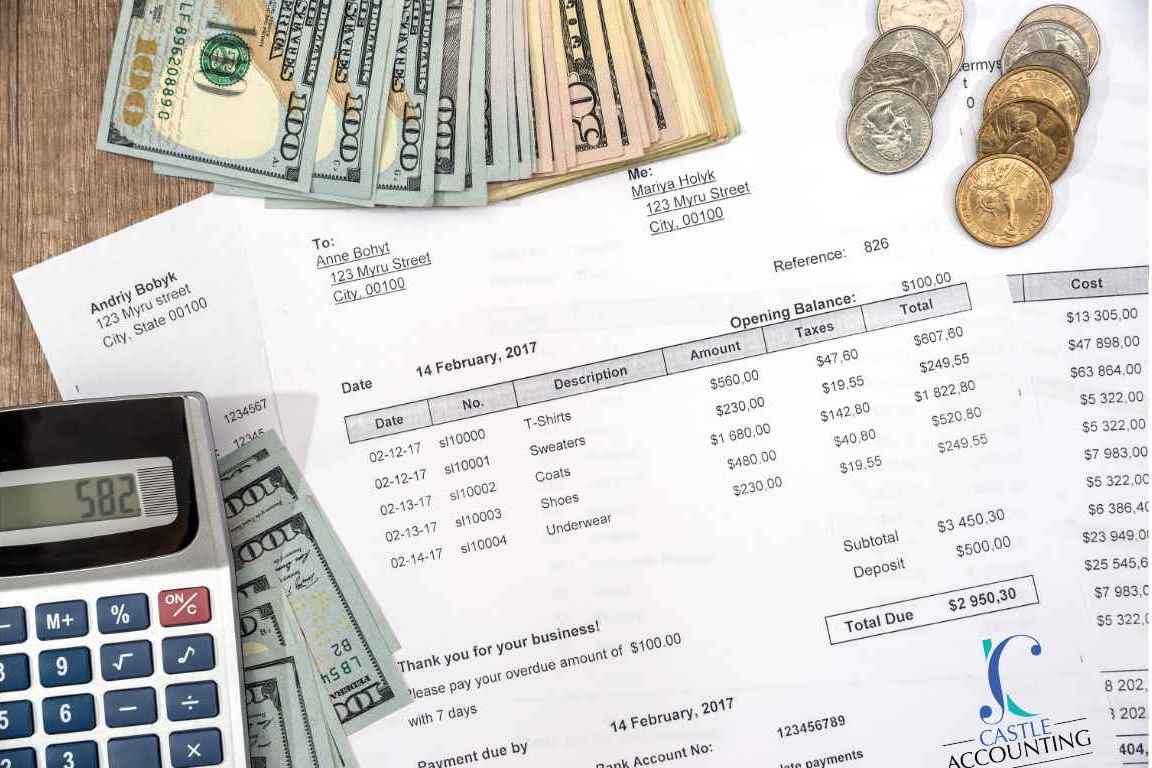

At JC Castle Accounting, we help business owners make smart financial choices. We'll explain the main differences between accrual and cash accounting. We'll look at the pros and cons of each to help you pick the best one for your business.

Key Takeaways

The accrual basis of accounting records revenue when earned and expenses when incurred, while the cash basis records transactions when cash is received or paid.

Accrual accounting provides a more accurate and comprehensive picture of a company's financial position, but can be more complex to implement.

Cash basis accounting is simpler to understand and maintain, but may not accurately reflect a company's true financial health.

The choice between accrual vs cash basis accounting depends on the size, industry, and financial reporting needs of the business.

Consulting with a professional accountant can help you determine the most suitable accounting method for your business.

Understanding Accrual Basis Accounting

Accrual basis accounting is a key way to track money. It records money earned or spent, not just when cash moves. This method gives a clear view of a company's finances by including things like bills and money owed.

What is Accrual Basis Accounting?

Accrual basis accounting means recording money earned and spent as it happens, not when cash is exchanged. This way, it matches income with costs for a true financial picture. It's the main method for big companies and needed for public ones in the U.S. because it follows GAAP rules.

When to Use Accrual Basis Accounting

Larger businesses with complex financial transactions, such as credit card payments and accounts receivable/payable

Compliance with GAAP, which is mandatory for public companies

Tracking assets and liabilities accurately to maintain a clear picture of the company's financial position

Small businesses that accept credit card payments or have a significant amount of accounts receivable and payable

Accrual accounting is chosen for its detailed and accurate financial view. It records money earned or spent, not just when cash moves. This helps businesses manage money better, make smart choices, and follow the law.

The Advantages and Disadvantages of the Accrual Basis Method

The accrual basis of accounting gives businesses a clear and accurate financial view. It records revenue and expenses when earned or incurred, not just when cash is paid. This method has advantages of accrual accounting. But, it also has disadvantages of accrual accounting that businesses should think about when choosing an accounting method.

Advantages of the Accrual Basis

Improved financial reporting: The accrual vs cash method records transactions when they happen, not just when cash is exchanged. This gives a clear and accurate view of a company's finances.

Better decision-making: With a full view of finances, managers can make smarter, long-term decisions.

Compliance with accounting standards: The accrual basis is the standard for generally accepted accounting principles (GAAP). It's the preferred choice for most businesses.

Disadvantages of the Accrual Basis

Increased complexity: The accrual method needs more detailed records and a good understanding of accounting. This can be more time-consuming and costly.

Higher risk of fraud: The accrual basis offers more chances for fraud. Employees can change when revenue and expenses are recorded to lie about the company's finances.

Potential for cash flow issues: If a business has a lot of accounts receivable but little cash, it might face cash flow problems. Even if it's profitable on an accrual basis.

When looking at the accrual basis accounting pros and cons, businesses must balance the accuracy and transparency it offers with its complexities and risks. The choice between accrual and cash-basis accounting depends on the company's specific needs and requirements.

Cash Basis Accounting: An Overview

In financial accounting, the cash basis accounting method is a unique way to track money. It's simpler than the accrual basis. This method records revenue when cash comes in and expenses when paid. It's great for small businesses or sole proprietors to see their cash flow clearly.

How Cash Basis Accounting Works

The cash basis accounting definition is simple: it tracks money only when cash moves. So, revenue is recorded when customers pay, and expenses when bills are paid. This gives a clear view of a company's cash flow right away.

Pros and Cons of Cash Basis Accounting

The advantages of cash basis accounting include its ease and quick cash flow insight. Small businesses and sole proprietors often choose it for its simplicity. But, it has downsides too. For example, it doesn't show the full picture of a company's financial health over time.

It also doesn't account for accounts receivable or payable. This can make profits seem higher than they are or hide financial problems. Also, the cash method doesn't meet GAAP standards and might not work for big businesses.

When looking at accrual vs cash accounting, know the cash accounting pros and cons. The cash method is simple and clear for now, but accrual gives a fuller financial view over time.

Conclusion

Choosing between accrual basis and cash basis accounting is crucial for businesses. Each method has its pros and cons. The best choice depends on the business's specific needs and situation.

The accrual method gives a detailed view of a company's financial health over time. It accurately shows revenue and expenses. On the other hand, the cash method is simpler. It suits smaller or cash-focused businesses that need to manage cash flow well.

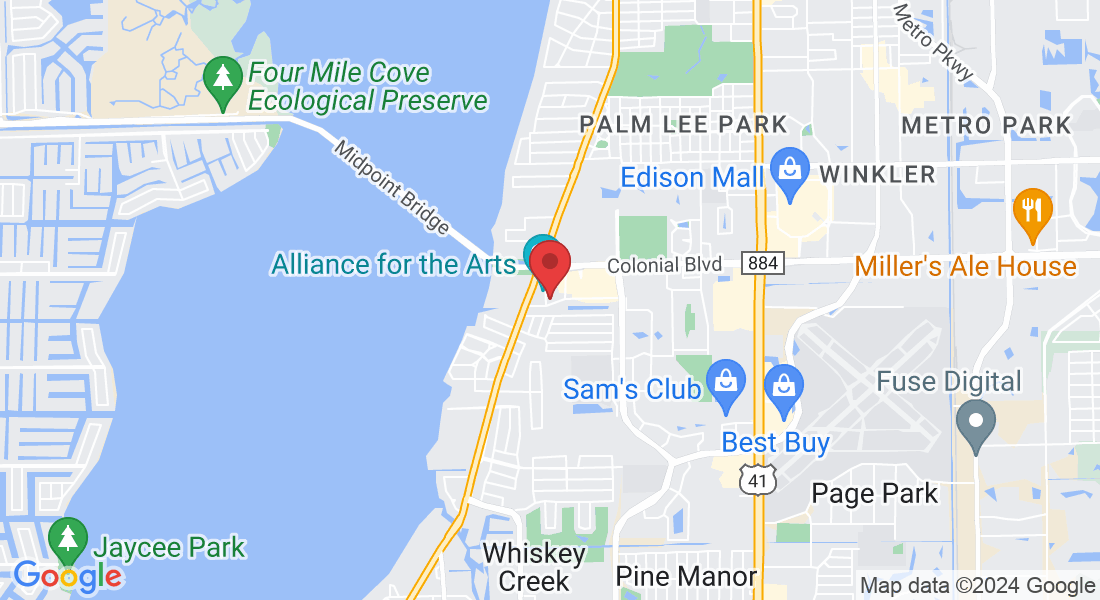

When deciding between choosing accounting method and cash vs accrual accounting best for business, consider your business size, industry, and tax needs. JC Castle Accounting can offer advice and support. They can help you pick the right method that fits your business goals.