INSIGHTS

____________________

How to save More Money with a Tax Accountant Fort Myers ?

Navigating the complex world of taxes can be an overwhelming task for anyone. if you're a Small business owner in Fort Myers trying to make sense of the new tax laws, the importance of finding the right tax accountant cannot be overstated. But the question that often lingers in the minds of many is: Are you overpaying for these services?

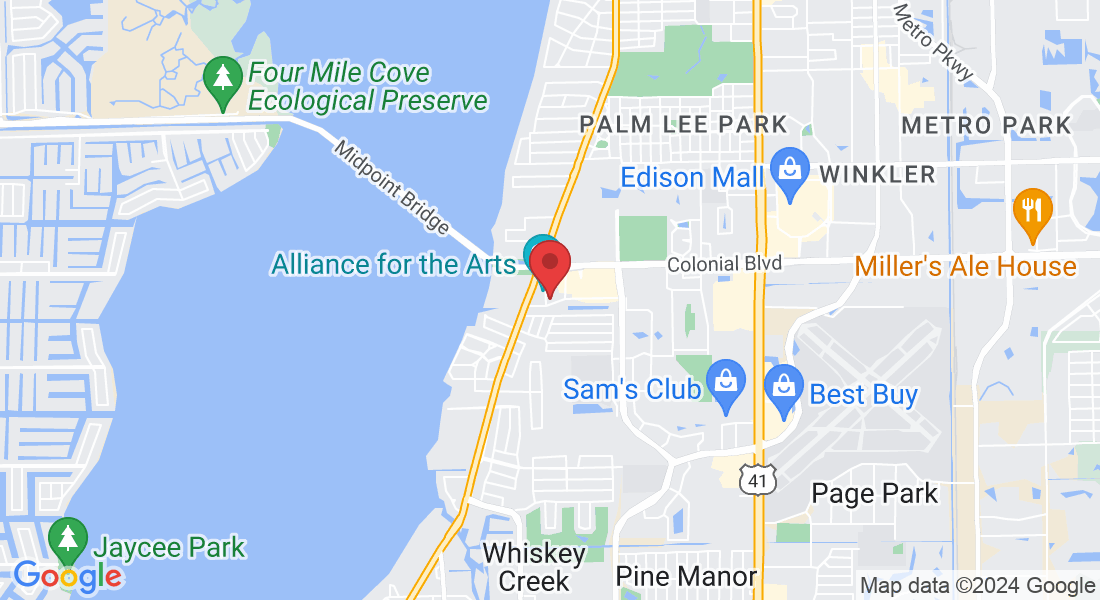

Fort Myers, a bustling city with a diverse economic base, is home to plenty of professionals claiming to offer the best tax preparation services. However, how do you ensure you are not only getting top-notch service but also value for your money? This article will guide you through choosing the right tax accountant Fort Myers and shed light on other related services like accounting firms in Miami, bookkeeping services Miami, and tax preparation Miami.

Understanding the Role of a Tax Accountant Fort Myers

A tax accountant Fort Myers is more than just a number cruncher. They are pivotal in ensuring that you or your business not only complies with tax laws but also takes advantage of all possible deductions and credits. This can significantly affect your financial health. Choosing the right tax accountant Fort Myers means looking for someone with a solid understanding of local and federal tax regulations, and who is capable of providing strategic advice tailored to your specific financial situation.

Why Choose a Tax Accountant Fort Myers

The main reason to hire a tax accountant Fort Myers is their localized knowledge. Tax laws can vary significantly by location, and Fort Myers is no exception. A local tax accountant Fort Myers will have a better grasp of specific deductions and credits that Floridians can claim, potentially saving you a significant amount of money.

Furthermore, a professional tax accountant Fort Myers can offer more than just tax preparation; they can help you with financial planning throughout the year. This can be crucial for businesses looking to expand or individuals planning significant investments or changes in their financial status.

What Services Do Tax Accountants in Fort Myers Offer ?

1. Tax Preparation: Clearly the core service, tax preparation in Fort Myers involves preparing and filing your annual tax returns. It is essential to ensure that all information is accurate to avoid any legal complications or potential fines.

2. Tax Planning: This proactive service involves strategizing with your tax accountant Fort Myers to manage your taxes throughout the year, rather than scrambling during tax season. It can help you make smarter financial decisions that minimize your tax liabilities.

3. IRS Representation: Should you face an audit, a qualified tax accountant Fort Myers can represent you before the IRS, providing support and ensuring that your rights are protected.

4. Financial Consulting: Many tax accountants in Fort Myers offer broader financial consulting, helping with budgeting, financial planning, and investment strategies.

The Benefits of Broadening your Horizons to Miami

While Fort Myers offers excellent resources, considering accounting firms in Miami can broaden your options. Miami's larger market means more competition, which can lead to more specialized services and potentially lower costs.

1. Accounting Firms in Miami: These firms often provide a full suite of services, from tax preparation to comprehensive business accounting, making them ideal for businesses with complex needs.

2. Bookkeeping Services Miami: For those looking to keep their daily financial transactions in order, Miami offers numerous bookkeeping services. Keeping accurate records is essential for effective tax preparation and financial planning.

3. Tax Preparation Miami: Like Fort Myers, Miami has professionals who specialize in both individual and business tax preparation. Exploring options in both cities can help you find the best match for your financial goals.

How to Choose the right Professional

When looking for a tax accountant Fort Myers or any accounting services in Miami, consider the following:

- Credentials: Ensure they are properly certified. CPAs or certified tax accountants have a significant level of credibility.

- Experience: Look for professionals with a proven track record in handling tax situations similar to yours.

- Reviews and References: Check reviews or ask for references to gauge the satisfaction of their clients.

- Cost: Discuss fees upfront to avoid any surprises. Remember, the cheapest option is not always the best.

Conclusion

Finding the right tax accountant Fort Myers or exploring bookkeeping services Miami can make a significant difference in your financial health. Whether you're looking for bookkeeping services Miami or tax preparation Miami, it's crucial to choose professionals who offer transparency, reliability, and tailored services. By carefully selecting your tax accountant Fort Myers, you can ensure that you are not overpaying for tax services and are getting the best possible return on your investments.

the goal is not just to pay taxes but to understand and manage them effectively. With the right partner by your side, you can navigate the complexities of tax laws confidently and ensure your financial future is secure.

FAQ

What should i look for when choosing a tax accountant Fort Myers ?

When selecting a tax accountant in Fort Myers, consider their credentials (such as CPA certification), experience in your specific tax situation, and local knowledge of tax laws in Fort Myers. Also, check their client reviews and discuss their fees upfront to ensure there are no surprises.

Can accounting and tax services in Miami help if i'm audited ?

Yes, if you face an IRS audit, qualified accounting and tax services from Miami can provide representation. They will support you throughout the process, help gather necessary documentation, and argue your case, aiming to achieve the best possible outcome.

What is the difference between tax preparation services in Miami and tax planning?

Tax preparation Miami involves compiling and filing your annual tax returns, ensuring compliance with the laws. Tax planning, however, is a more proactive approach that involves strategizing throughout the year to minimize tax liabilities and maximize potential returns.

Subscribe To Our Weekly Newsletter

Subscribe To The mailing list To keep up With new Features & Updates from Jc Castle Accounting

Categories

Bookkeeping

Business & Personal Taxes

Payroll

Most Popular

Are you struggling to navigate the world of estate taxes? Do you find yourself overwhelmed by the complexities of managing your legacy? If so, you’re not alone...

February 23, 2024

Outsourcing accounting services can be a great way to improve your business’s cash flow and profitability. Outsourced accounting services miami fl not only frees up time..

March 27, 2023

When it comes to estate planning and taxes, there’s often a sense of uncertainty and confusion. So, How can I ensure that my assets are protected, and my family is taken care of...

February 19, 2024

Mary is a small business owner who’s passionate about her gourmet bakery. As her business grows, she has been facing challenges, especially managing payroll...

January 11, 2024

In the dynamic real estate world, accounting holds a pivotal role in every transaction, carrying substantial financial weight. Accurate accounting is key for property dealings...

January 15, 2024

An accounting Services Small Business South Florida company is a business that provides financial and management services to small & big businesses.

March 29, 2023

Did you know that small businesses that engage in professional bookkeeping services in Miami experience an average revenue growth of 15%? This surprising statistic...

February 12, 2024

Did you know that the new tax laws coming into effect in 2024 will have a profound impact on small businesses in the United States? Indeed, compliance with these laws..

February 21, 2024

As the business landscape continues to evolve at a rapid pace, accounting firms in Miami have found themselves facing new challenges. To stay ahead of the curve, these agile firms...

February 21, 2024

Are you running a business in Miami and struggling to keep up with the complexities of bookkeeping? Do you find it challenging to maintain accurate financial records ...

February 20, 2024

You can contact the regional order of Chartered estate tax accountant directly, which will provide you with a list of local estate tax accountant near me. Another option is...

March 29, 2023

For any financial, tax, social, or legal inquiries, our Hollywood, Florida accounting firm is ready and committed to assisting business leaders in need of expert advice and...

February 17, 2022

Are you running a business in Miami and struggling to keep up with the complexities of bookkeeping? Do you find it challenging to maintain accurate financial records ...

February 20, 2024

Book Your Free Consultation With Jc Castle accounting

We pride ourselves on our consultant feature

So Ready to take the next step towards achieving financial success?

Book A free Appointment with Candace today to learn more about our services and how we can help your business thrive.

© 2024 JC Castle Accounting - All Rights Reserved

Powered By Funnels Lab